Understanding Lowest Mortgage Rates

Introduction

In the quest to own a home, securing the lowest mortgage rates can make all the difference. Understanding the intricacies of mortgage rates saves money and time. This guide will unravel the components influencing low mortgage rates.

Advertisement

What Are Mortgage Rates?

Mortgage rates refer to the interest charged by lenders on a home loan, expressed as an annual percentage. These rates directly affect the monthly payment and total loan costs. Lower rates mean less money paid back over the loan's lifespan.

Advertisement

Average Rates vs. Lowest Rates

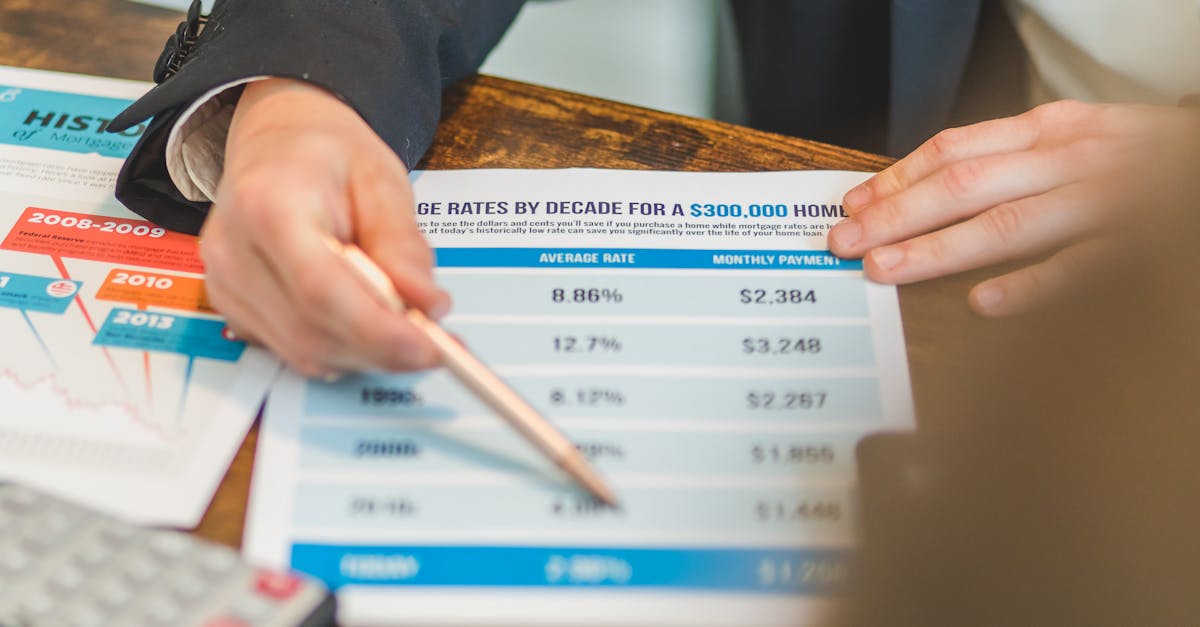

Average rates represent the typical mortgage interest across various lenders at a specific time. However, the lowest rates are special offers that some lenders provide to attract customers or under specific conditions. While average rates give a general market idea, seeking the lowest rates can be more rewarding.

Advertisement

Factors Determining Mortgage Rates

Several factors influence mortgage rates, including the federal funds rate set by central banks, housing market stability, and economic factors like inflation. Personal factors such as credit score, loan term, and size also play significant roles.

Advertisement

Impact of Credit Scores

A borrower's credit score significantly affects the mortgage rate they qualify for. Higher credit scores often lead to lower interest rates as they reflect financial responsibility. Lenders perceive borrowers with good credit as less risky, offering them favorable terms.

Advertisement

Loan Terms and Their Influence

The duration or term of a mortgage impacts the interest rate. Typically, shorter-term loans, like 15-year mortgages, attract lower rates compared to 30-year mortgages due to quicker repayment, which lowers lender risk.

Advertisement

Role of Down Payments

Lenders often offer lower rates to borrowers who make substantial down payments. A larger down payment reduces the loan amount, minimizing the lender's risk. As a result, borrowers can secure more favorable interest rates.

Advertisement

Exploring Different Loan Types

Different mortgage types, such as fixed-rate and adjustable-rate, come with varied interest rates. A fixed-rate mortgage provides stability with unchanging rates, whereas adjustable-rate mortgages might start with lower rates but can increase over time based on market conditions.

Advertisement

Strategies to Secure Lowest Rates

To obtain the lowest rates, borrowers should consider improving their credit scores, making higher down payments, and exploring various lenders. Shopping around and comparing offers is essential, as lender terms can widely vary.

Advertisement

Summary or Conclusion

Securing the lowest mortgage rates entails understanding influencing factors and personal financial preparation. By considering credit scores, loan terms, and comparing lenders, potential homeowners increase their chances of obtaining favorable rates. In essence, preparation and informed decision-making pave the way to affordable homeownership.

Advertisement